In this article we are going to share our experience with the VAT refund as residents of the Canary Islands, the famous TAX Free for canaries that we buy in the Peninsula and the Balearic Islands. In case you didn't know, residents of the Canary Islands can deduct VAT on purchases we make in the Balearic Peninsula and Archipelago. This is, as a general rule, one 21%. Therefore, if you plan to buy high-value items, it compensates you request a VAT refund, since you only have to pay the IGIC as a Canarian or resident in the Canary Islands. In this practical case, We are going to tell you how for purchases of €1.470 (VAT included) they refunded me €255,12 for VAT. Here we go!

VAT refund process for residents of the Canary Islands

First of all, we want to tell you that as of today (June 2023) this process is VERY cumbersome and not agile at all. Therefore, we only recommend it as long as your purchases have been for a high amount (more than €1.000) so that it compensates you for the time spent. That is, for €30 or €50 I at least wouldn't do it. That being said, below We share with you the complete process so that you can request a VAT refund as a Canarian resident for purchases you make in the Peninsula and the Balearic Islands.

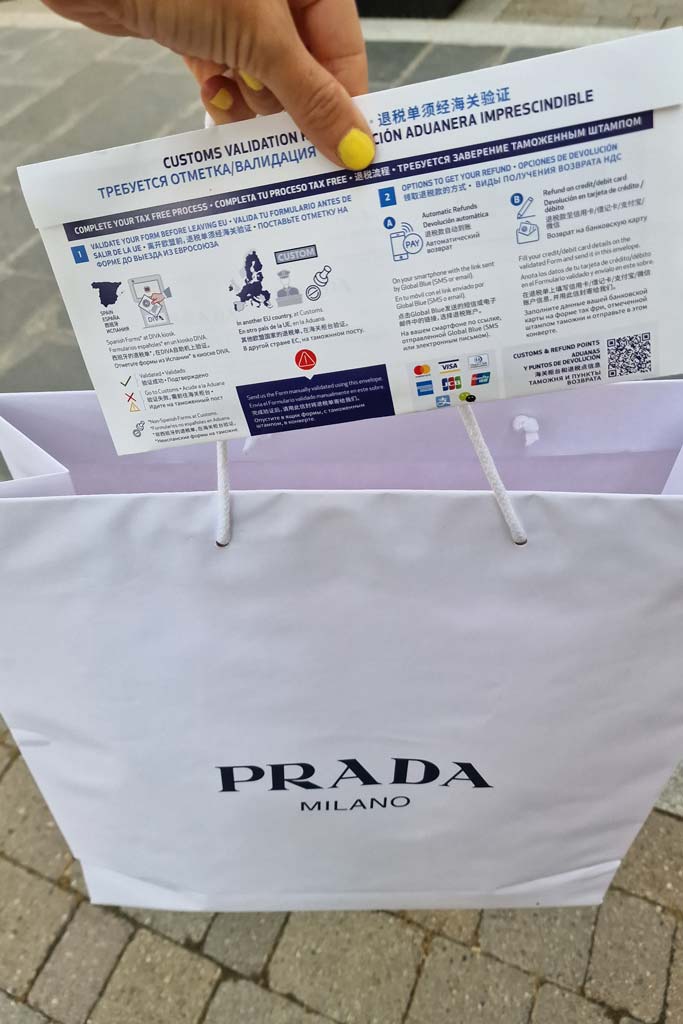

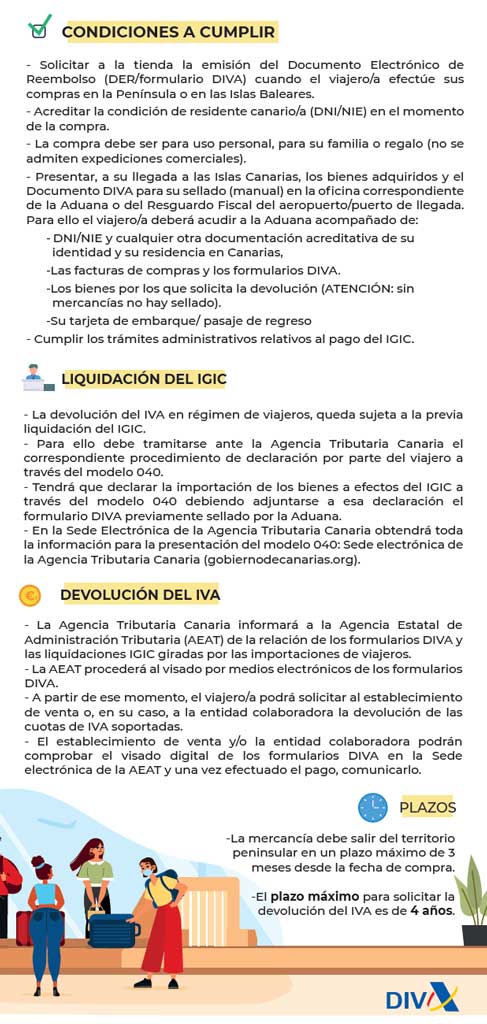

- When you buy in the Peninsula and the Balearic Islands, Request the Electronic Refund Document or “TAX FULL VAT” or TAX FREE form along with the purchase receipt. Remember bring your ID and a bank card so they can complete the form.

- Once you land in the Canary Islands, We validate the TAX FREE form at the island airport customs (they have to stamp it for us at the Civil Guard). In the case of Las Palmas airport, we find it next to the national flight departure. Here you must present the TAX Free form, purchase tickets, boarding pass, your ID, as well as show the purchased merchandise so that they can verify that it has entered the Canary Islands. There is nothing to do at the mainland/balearic airport.

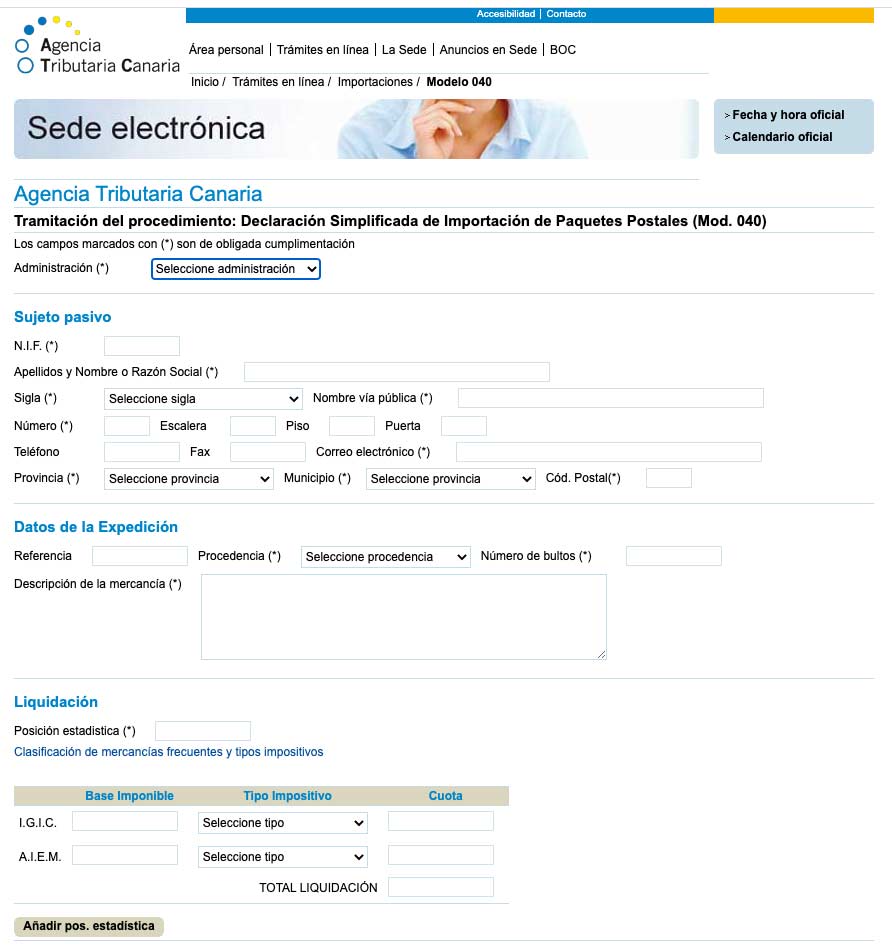

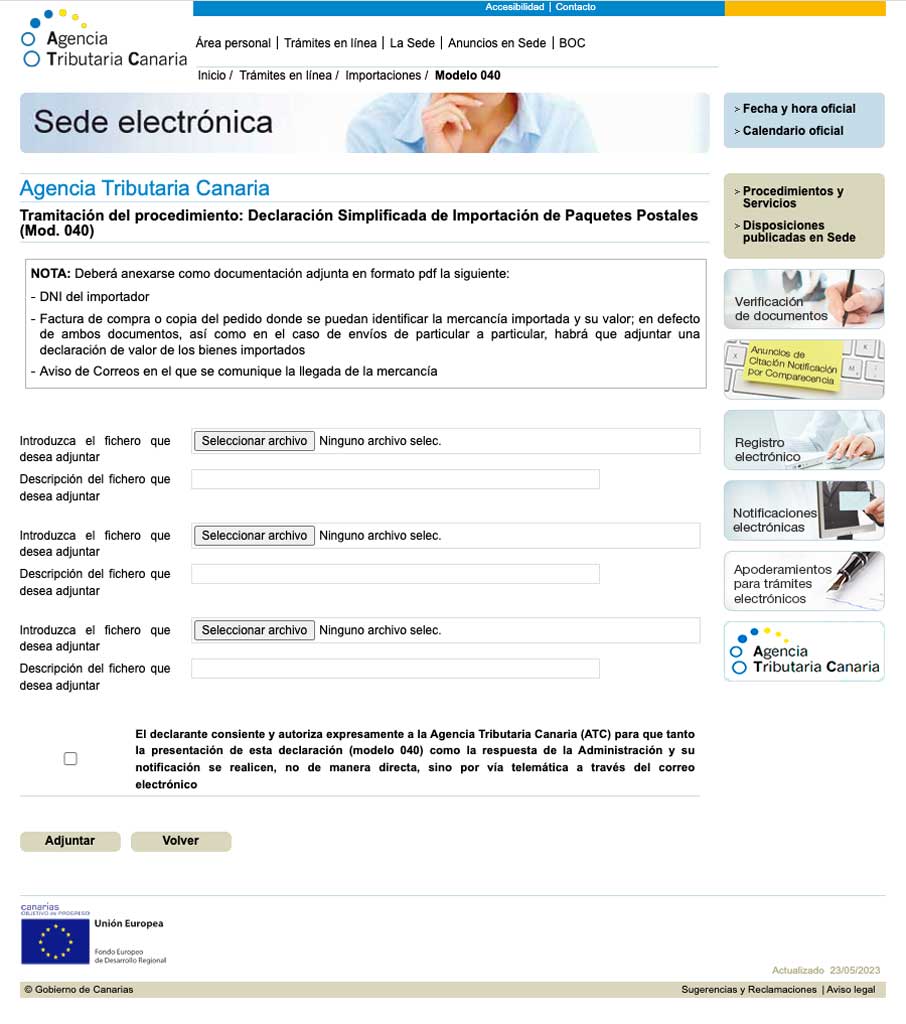

- Once we have the document sealed, we complete the model 040 on the website of the Canarian Tax Agency attaching the sealed documentation and ID in PDF format (we explain the complete process below).

- Then when the Canarian Tax Agency validates all the documentation presented in form 040, makes you get the model 032 by email so you can make the IGIC payment. It takes 1-2 days to send you this IGIC settlement model. We explain this step in more detail below.

- Once you have paid the IGIC corresponding to your purchases, All that remains is to send the invoice sealed by customs in the postage-paid envelope that the business has given us.. In principle it is not indicated that form 032 must be attached, but I sent it too. A priori the two tax administrations (Canarian and state) are "connected" and They can verify that the IGIC has already been settled so that they can refund the VAT.

How do you fill out form 040 to pay the IGIC and request a VAT refund?

First of all, you must fill in your personal information: ID, name, etc. Then, in the Shipping DataIn my case in reference I put 1, national origin and number of packages 1. In the description, since it is a bag and a wallet I write «Bags, wallets and suitcases».

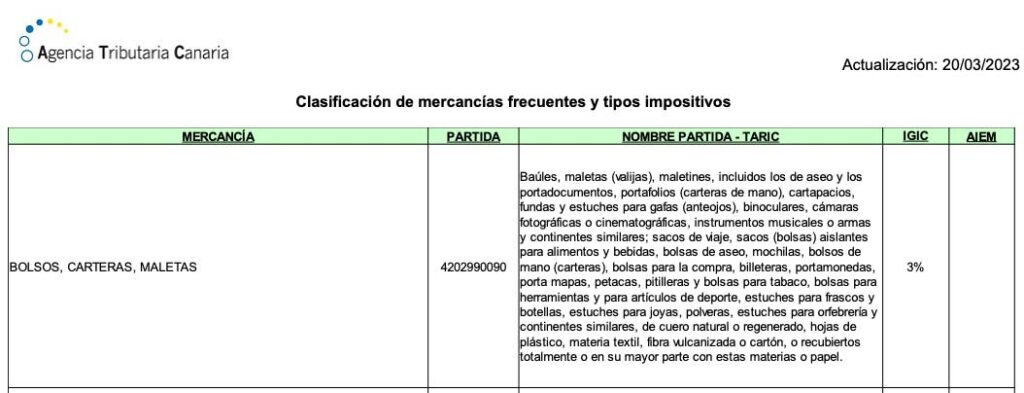

Then, in the In the Liquidation section we have to click on "classification of frequent merchandise and tax rates" to find the item number that corresponds to the item you have purchased and thus, be able to include the statistical position number. In this case, since it is a bag and a wallet, We include the number that you indicate in the table in the “statistical position” space. In this case it is 4202990090. The tax rate to which the articles are subject is also detailed. In this case it is the 3%. In the tax base, We include the sales price without VAT, which will be detailed in the invoice that the business gives us: €1.214,88 in my case. Then we mark the % of IGIC to which that article is subject (3% in this case) and the calculation is automatic: 36,45€.

Next, in the “representative information” section I did not fill out anything in my case. Then in the next step we can Choose whether to present the document electronically (Submit button) or if we do it in person (Generate printed button). In my case, I chose telematically and it takes you to the next screen. One has to attach in PDF format of the two-sided DNI and pdf of the Tax Free invoice. If you do not attach it in PDF, it will not let you validate it. I also attached the simplified invoice/purchase receipt. Then, a receipt will be generated for you, which will be what the administration must verify. It took 1-2 days as I told you in step #4.

How is form 032 managed and paid?

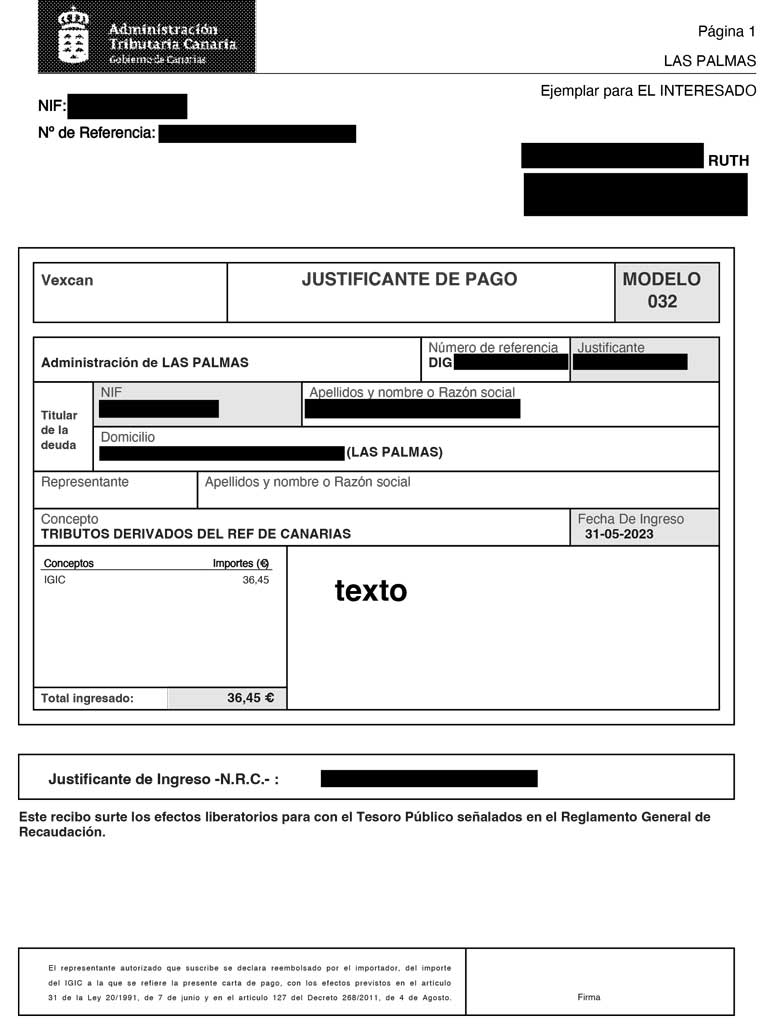

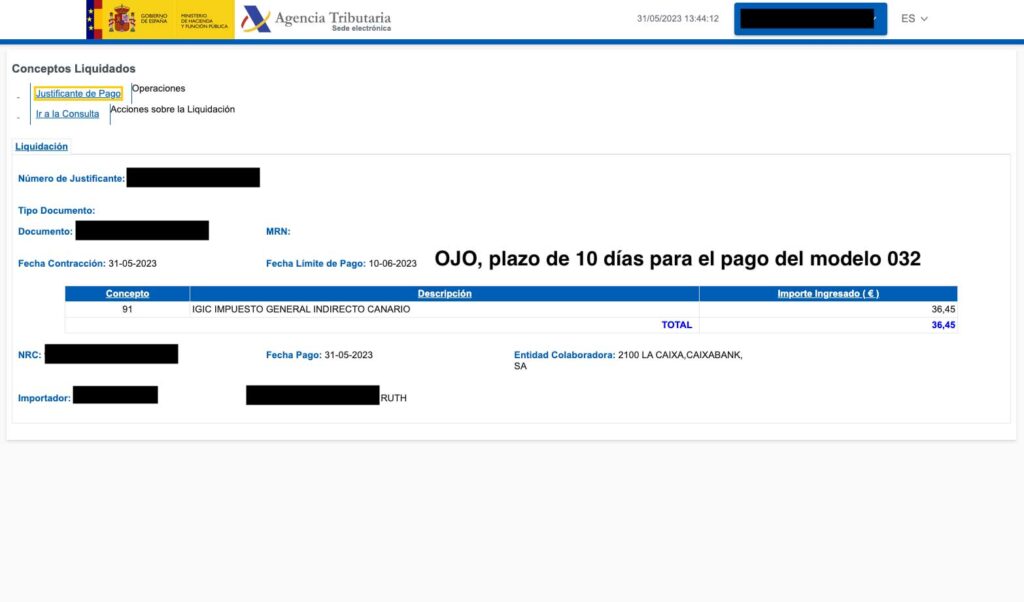

Next, we explain what to do when you receive the “payment letter for form 032” by email to be able to make the payment. payment of the IGIC of your purchases made in the Peninsula and the Balearic Islands as a resident in the Canary Islands. You can pay for form 032 electronically on the website. vexcan.es. We show you ours as an example and below we detail the steps to follow.

If you have an electronic certificate, it will ask you to validate access. Once inside, you must go to Payment of settlements > Payment and consultations of foreign trade settlements > Consultation of groups > settlements pending payment. Next, you must include the bank account number so that the IGIC of your purchases can be charged and which has already been calculated using form 040. Here you can see how I paid my €36,45 IGIC online. I couldn't tell you how to do it in person (below I leave the contact information for questions). IMPORTANT: Keep in mind that you only have a period of 10 days to pay form 032 once you receive it from the Canarian Tax Agency by email.

VAT refund period for Canarian residents

In my case, once the IGIC has been settled, I sent the postage-paid letter that was delivered to me at the store on June 1 by post (step #5). On June 26 I receive an email from the Tax Agency and, at the same time, another from Global blue (tax return intermediary) where they tell me that my form has been validated and that The tax refund will be credited to the card registered on the TAX FREE form. On June 27, I receive the €255,12 in the bank account associated with my card. This is about 26 days, without counting steps 1, 2, 3 and 4 that will take you a couple of days. I hope this article helps a little less.

More deadlines to take into account for the TAX Free of the canaries exempt from VAT

- La merchandise must leave the peninsular territory or the Balearic Islands within a maximum period of three months from the date of purchase

- The maximum period to request a VAT refund is 4 years

- Within 10 days to pay form 032 to settle the IGIC once you receive it from the Canarian Tax Agency by email.

Conclusions VAT refund to residents in the Canary Islands

Ultimately, Of purchases of €1.470, they refunded me €255,12 for VAT and I paid €36,45 for IGIC. What I'm left with 218,67€ Of diference. Keep in mind that if you do not request this process, you would be paying more, but as I say, given how complex it is, It only compensates for high value purchases. Similarly, The amount of IGIC to pay in my case was only 3% of the net amount, but there are items that are subject to 7% (sunglasses) and 15% (gold, silver watches, etc.). You can see the full table here. Below, we also explain the process in our YouTube channel.

Basic tax information telephone number in the Canary Islands

There is a telephone basic tax information in which you can clarify doubts. They helped me a lot, since I couldn't find any complete explanation of the entire process on the internet.

We also leave you the informative brochures from the Tax Agency that were sent to us from Prada by WhatsApp, the store where we made the purchases in case it is more helpful to you.

As you can see, it is a brief summary of the entire process that we have outlined in this article. We hope this has been helpful to you, if so, I would love to read from you in the comments. For any questions, consult the detailed telephone numbers, since we are not experts and we only have experience with a single purchase., we are unaware of all the cases that may exist with other items that are associated with another IGIC, non-telematic processes, several purchases, etc.

We are Ruth & Jorge, Gran Canarian people with a traveling soul. Experts in tourism and digital marketing. We share the most authentic side of Gran Canaria (where we live) and… our adventures around the world!

Good morning, yes I don't have an envelope because they didn't give it to me in the store. Can I use a normal envelope, put a stamp on it and send it to the address of global blue Spain?

Hello Cristina! Contact the business that created the tax free form to find out what steps you should follow... perhaps they have given you other guidelines or they work with another operator other than Global Blue.

Good afternoon,

Thank you very much, first of all, your video has been very helpful to me.

My question is: I already have form 032 paid for and I have the receipt. Would all the procedures be ok? Now would it be to put the tickets, the diva form, model 040, model 032 paid into the envelope and send it without further ado?

Hello Aday!

In principle I think so. Sorry, but I'm not very familiar with the procedure, that's why I wanted to share everything since I did it because since it is something that I don't practice daily, it is quickly forgotten.

To corroborate it, better consult the instructions they have given you or the telephone number that I share.

A hug and good luck, now we'll wait a month hehe

Good afternoon, I am filling out the Tax information, I have photographs and t-shirts. photographs 7% and t-shirts 3%

Would it be filling two mod. 40?

Thank you very much

You can ask the number mentioned in your blog

Hi carmen! Better to consult the contact numbers, this is a guide/example with a practical case, I do not know all the individual purchase cases, since I have only done the process once.

Thank you!

Hello! Very well explained, thank you very much.

I have a question, I don't know if you will be able to answer it, if not, I will ask the Tax Agency.

Is the step of sending the letter by CORREOS explicitly mandatory?

We have made 2 separate purchases and in neither of them have they given us any envelopes. And until now I didn't know or had any idea about the envelope.

Regards!

Hello Beatriz! I'm glad it helps you.

I think so... but if not, follow the steps that they told you in the business where they gave you the VAT invoice... I have only done it once and that is what they explained to me (after asking MANY SOURCES). Everything worked perfectly.

A greeting!

Thank you very much for the information, useful to consider buying in Peninsula. Thank you

to you!! a hug

Hello again, I'm Carlos. I'll give you a little more context to see if it's worth doing the procedure for me.

The idea is to buy the iPhone 15 Pro Max when it comes out on the peninsula (€1469). On the islands (Banana Computer) I have seen that its price will be €1419. Therefore, it is not worth it for my sister to bring it to me from the Canary Islands for €50.

So if the approximate VAT amount for the iPhone is €259, would it be worth doing the whole procedure?

Thank you very much, greetings.

Hi Carlos!

From what I see in the "Classification of frequent merchandise and tax rates" table, mobile telephony has a 7% IGIC associated with it, so to know if it compensates you, you have to calculate €1.469 – 21% VAT + 7% IGIC ( on the tax base) and you see if it compensates you.

The calculations will be estimates, since it is not clear to me if Global Blue gets a piece of the pie. The purchase amount is similar to my example, but keep in mind that my bag was subject to 3% IGIC and not 7%, which is the case with mobile telephony.

A hug!

Very good post!

One question: If the item is a cell phone, could that cell phone be returned to the peninsula without a problem? That is to say, my sister who lives in the Canary Islands takes it so she can take advantage of the IGIC and not the VAT and then brings it back to me since the mobile phone would be for me, since I am not a Canary Islands resident.

Thank you.

Hi Carlos!!

I'm glad it helps you, yes of course, there is no way for them to check where the cell phone is and it could also be a gift. Of course, the purchase must be made by your sister and therefore the invoice must be in her name. Then at the airport the stamping of the merchandise proving that it enters the Canary Islands must also be done by her.

In any case, check the prices of mobile phones on the websites of the Canary Islands businesses, since electronics in general are cheaper in the Islands and you may not save much with the procedure. The same goes for perfumes, tobacco and other items.

All the best

Great contribution and very complete.

I'm going to be specific with the following question: I have paid for a VPN subscription to the NordVPN company. Of course, this international company is surely not aware that the tax in the Canary Islands is 7%, so it has saddled me with 21% in taxes, understanding that the Canary Islands belong to Spain.

Well, that being said. Is there any possibility as a Canarian Resident to request that difference?

Hello Jason!

If I'm not mistaken, it is the company that has to rectify the invoice, they cannot issue it to you with VAT unless when requesting the invoice you have provided a tax address in the peninsular territory/Balearic Islands.

Talk to your department. support so they can rectify it, every time we buy something digital and ask for a company invoice, we have to ask for it manually too, they don't have it automated because there are few of us who know it hehe.

A abrazo.

Good afternoon: and can I request a refund of VAT for air conditioning equipment purchased on the peninsula and installed on the peninsula, as I am a resident of the Canary Islands?

Hi Eduardo! VAT can only be requested when the product is purchased in the Peninsula and taken to the Canary Islands (the same person who buys it must take it). At customs you have to show the merchandise and the Civil Guard checks the invoice with the items to put the stamp on it. So the answer is NO 🙂 hehe.

Hello, thank you very much for this post, super useful!! Just one question: can it also be applied for services? That is, if I go to a restaurant, an event, etc., can I also request a VAT refund?

Hello Erik!! I don't think so, I hope hahaha we are talking about merchandise in this specific case 🙂

I'm glad it was helpful to you, the truth is that there was no information on the internet sharing the complete process, that's why I decided to do it :)

All the best